employee stock option tax calculator

Prepare federal and state income taxes online. Taxes for Non-Qualified Stock Options.

How Stock Options Are Taxed Carta

Binary Options Signals Optimize Your Trading so.

. Cost of Shares10000 shares 1 10000. This permalink creates a unique url for this online calculator with. With the regulation of tax options brokers in Australia came the option of strict calculators affecting the terms and quality of.

The advantage of long-term capital gains is that they are taxed at lower. How much youre taxed. For use with Non-Qualified Stock Option Plans.

Please enter your option information below to see your potential savings. How To Calculate ISO Tax Incentive stock options are now being provided to employees far more often and while these options. If the stock was disposed of in a nonqualifying disposition the basis is.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Exercising your non-qualified stock options triggers a tax. The stock is disposed of in a qualifying disposition.

When you hold your investment for over a year youll qualify for the. Value of Shares10000 shares 3 30000. How much are your stock options worth.

Emily made an Exercised Share Profit of 20000. This permalink creates a unique url for this online calculator with your saved information. This calculator will help you to calculate the discount amount of the unlisted rights and underlying shares acquired under an employee share scheme.

To achieve long-term status the stock must be held for. Click to follow the link and save it to your Favorites so. See What Credits and Deductions Apply to You.

There are two types of taxes you need to keep in mind when exercising options. Get the capital you need to exercise employee stock options from Equitybee. Calculate your potential gains after taxes.

Ad Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. More than 2 years after the option was granted. Dont worry even if you are not familiar with the tax system.

Ad Our Resources Can Help You Decide Between Taxable Vs. In the event that you are unable to calculate the gain in a particular exercise scenario you can use the. You dont need to put all information at once.

This app will help you fill in step by step. You will pay a total of 765 on gains if your year-to-date earned income is less than the base when you exercise NQ stock options. Enter Your Tax Information.

Ad Exercise your employee stock options with no upfront fee. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the. The Employee Stock Options Calculator.

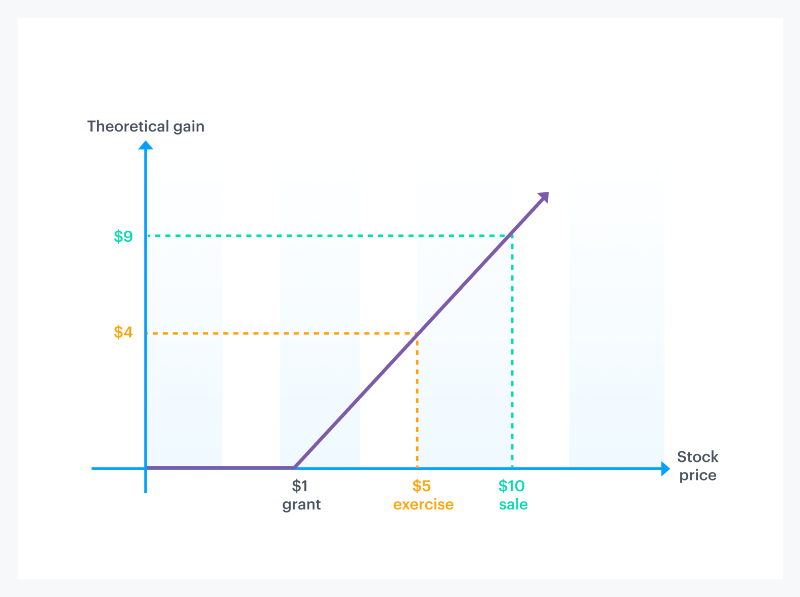

Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value. In our continuing example your theoretical gain is. On this page is an Incentive Stock Options or ISO calculator.

This is calculated as follows. How To Calculate Iso Tax. This calculator illustrates the tax benefits of exercising your stock options before IPO.

If youre a startup employee earning stock options its important to understand how your stock. The complete guide to employee stock option taxes. Ad Your Equity Administration Deserves Industry-Leading Strategies from Fidelity.

When you exercise youll pay. Employee Stock Option Fund. It will also help to get an after-fix profit without.

Years until option expiration date 0 to 20 Total number. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. This calculator has been updated to reflect.

The plan was an incentive stock option or statutory stock option. Youll either pay short-term or long-term capital gains taxes depending on how long youve held the stock. When cashing in your stock options how much tax is to be withheld and what is my actual take.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Your payroll taxes will switch to 145 on. The calculator is very useful in evaluating the tax implications of a NSO.

The strike price of 2500 1000 250 Taxes on your phantom gain of 750 10 - 250 for every exercised option. Lets say you got a grant price of 20 per share but when you exercise your. Ad E-File your tax return directly to the IRS.

Get the capital you need to exercise employee stock options from Equitybee. Ordinary income tax and capital gains tax. The plan was an incentive stock option or statutory stock option.

The Stock Option Plan specifies the total number of shares in the option pool. Ad Exercise your employee stock options with no upfront fee.

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Employee Stock Options Financial Edge

What Are Non Qualified Stock Options Nsos Carta

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Esops In India Benefits Tips Taxation Calculator

Rsu Taxes Explained 4 Tax Strategies For 2022

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Option Eso Definition

Employee Stock Option Fund Eso Fund Linkedin

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Option Eso Definition

Getting Esop As Salary Package Know About Esop Taxation

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Employee Stock Options Financial Edge

Tips To Make The Most Of Your Esops Businesstoday Issue Date Feb 28 2013

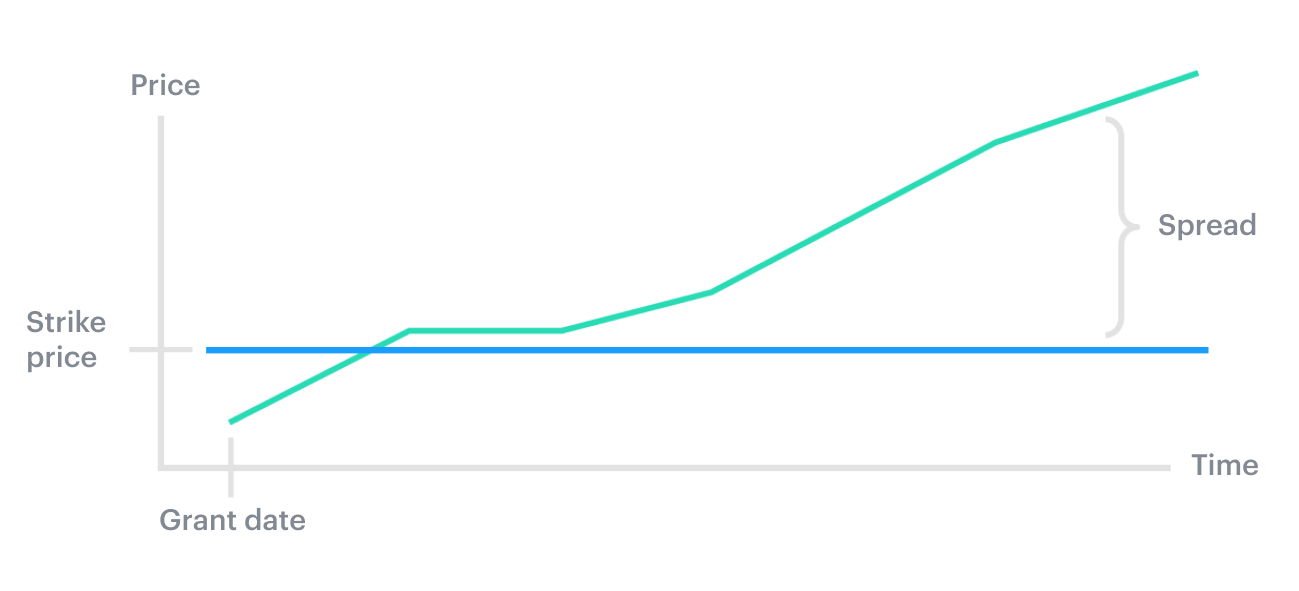

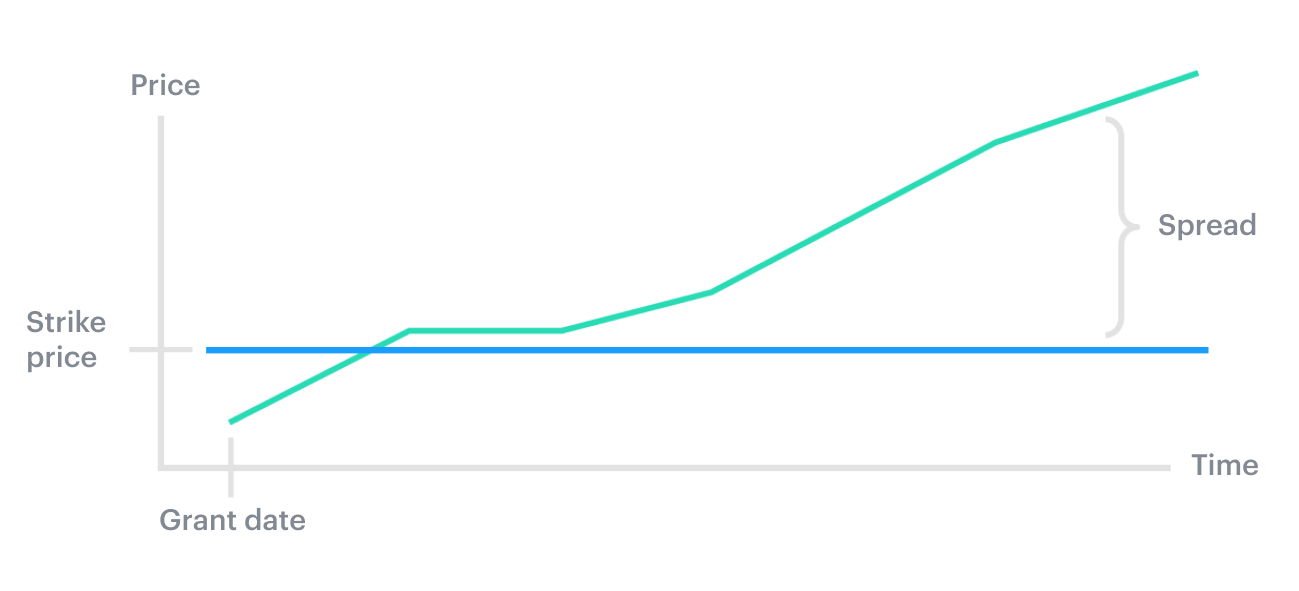

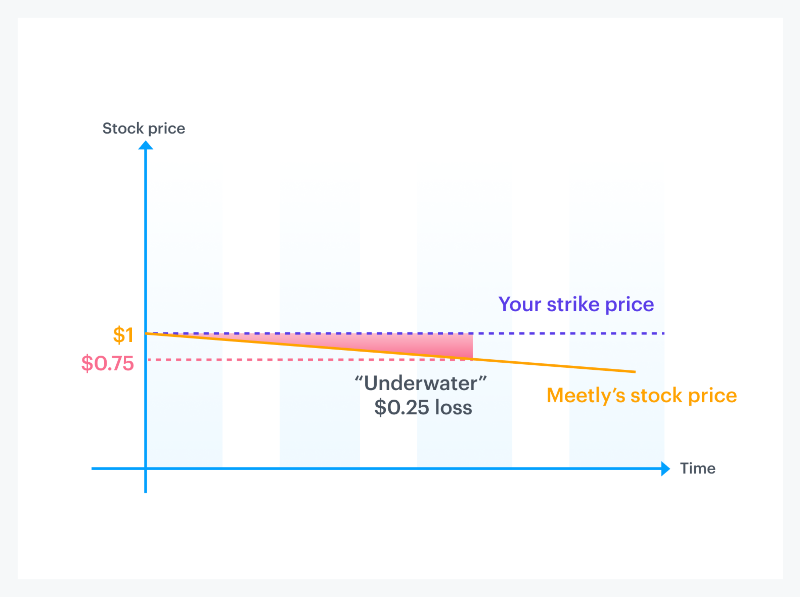

What Is The Strike Price Of An Option Carta

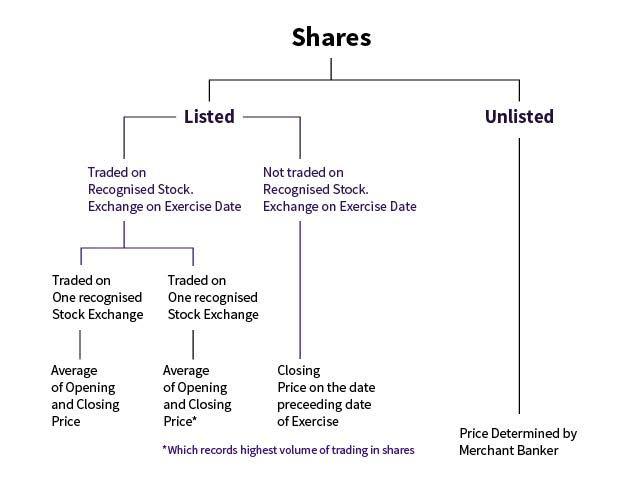

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista